Anti Money Laundering Bahrain

The idea of cash laundering is essential to be understood for those working within the monetary sector. It's a course of by which dirty money is converted into clear cash. The sources of the cash in actual are criminal and the cash is invested in a method that makes it appear like clear cash and hide the id of the felony part of the cash earned.

While executing the monetary transactions and establishing relationship with the new prospects or maintaining existing clients the responsibility of adopting satisfactory measures lie on each one who is part of the organization. The identification of such ingredient in the beginning is straightforward to deal with instead realizing and encountering such situations afterward within the transaction stage. The central financial institution in any nation gives full guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to discourage such conditions.

It is clear that the Kingdom of Bahrain is currently focused on imposing strict procedures on all legal professionals in Bahrain. 772017 regarding Anti Money Laundering Terrorism Funding procedures imposed on Notary Public.

Bahrain S Measures To Combat Money Laundering And Terrorist Financing

Bahrains tough new anti money laundering rules came into effect yesterday bringing the Bahrain Stock Exchange entirely under the control of the Bahrain Monetary Agency.

Anti money laundering bahrain. Bahrain is also a member of the regional MENA-FATF. Bahrain is part of the Financial Action Task Force FATF through the full membership of the Gulf Cooperation Council in the FATF and is. 292020 amending Bahrain Decree-Law No.

- Bahrain is a leading financial center in the Gulf region. FATF 40 recommendations on Money Laundering and 9 Special Recommendations on Terrorist Financing. 4 of 2001 with Respect to the Prevention and Prohibition of the Laundering of Money.

In January 2001 the Government of Bahrain enacted an Anti-Money Laundering AML law that criminalizes the laundering of proceeds derived from any predicate offense. The full text can be viewed here. Bahrain anti money laundering rules.

This Detailed Assessment on Anti-Money Laundering and Combating the Financing of Terrorism for the Kingdom of Bahrain was prepared by a staff team of the International Monetary Fund using the assessment methodology endorsed by the Financial Action Task Force in February 2004 and. Anti-Money Laundering Combating the Financing of Terrorism. US Department of State Money Laundering assessment INCSR Bahrain was deemed a Jurisdiction of Concern by the US Department of State 2016 International Narcotics Control Strategy Report INCSR.

Anti-Money Laundering Combating of Financial Crime CHAPTER AML-B. Bahrain has a primarily service-based economy with the financial sector providing roughly 18 percent. The Ministry of Finance The Committee for drawing up policies for the prohibition and combating money laundering formed by Ministerial order No8 of 2012.

ICLG - Anti-Money Laundering Laws and Regulations - covers issues including criminal enforcement regulatory and administrative enforcement and requirements for financial institutions and other designated businesses in 29 jurisdictions. The Financial Action Task Force FATF is an independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering terrorist financing. Bahrain is part of the Financial Action Task Force FATF through the full membership of the Gulf Cooperation Council in the FATF and is committed to the implementation of all international standards in this area.

On the 23 rd Nov 2017 the Minister of Justice also issued Order No. Anti-Money Laundering Anti-Terrorism Financing Policy Procedures AFS is regulated and supervised by the Central Bank of Bahrain. Bahrain is one of the members of the Co-operation Council for the Arab States of the Gulf GCC which is a member of the FATF.

Anti-Money Laundering Laws and Regulations 2021. Bahrain Anti-money laundering and counter-terrorist financing measures Kingdom of Bahrain Mutual Evaluation Report. The Ministry of Industry Commerce and Tourism - Anti-Money Laundering Unit.

Bahrain Anti Money Laundering Law 2001. The Anti-Money Landry Department can be reached by. Anti-Money Laundering NBB is a public share holding company listed in Bahrain Bourse.

The applicable Anti-Money Laundering laws and regulations in Bahrain include but are not limited to the following. The new amendments expand the criminalisation of money laundering to include any criminal activity provided for. 4 of 2001 With Respect to the Prevention and Prohibition of the Laundering of Money.

The Ministry of Justice and Islamic Affairs The Follow-up Unit at the General Registrars office. Article 2 Offence of Money Laundering. The agency is now the sole regulator for the entire capital markets with a.

42001 on prohibiting and tackling money laundering and terrorist financing. The Foreign Affairs Defence and National Security Committee of Bahrains Parliament has approved Bahrain Law No. The CBB requires all conventional banks in Bahrain to comply with the applicable laws regulations and must implement programmes against Money Laundering and Terrorist Financing by establishing and maintaining appropriate systems and controls to limit the vulnerability to Financial Crime.

The law stipulates punishment of up to seven years imprisonment and a fine of up to one million Bahraini dinars BD for convicted launderers and those aiding or abetting them. Scope of Application AML-B1 Scope of Application AML-B11 This Module contains the CBBs Directive relating to Anti-Money Laundering and Combating of Financial Crime and is issued under the powers available to the CBB under Article 38 of the CBB Law. The Central Bank of Bahrain The Compliance Directorate.

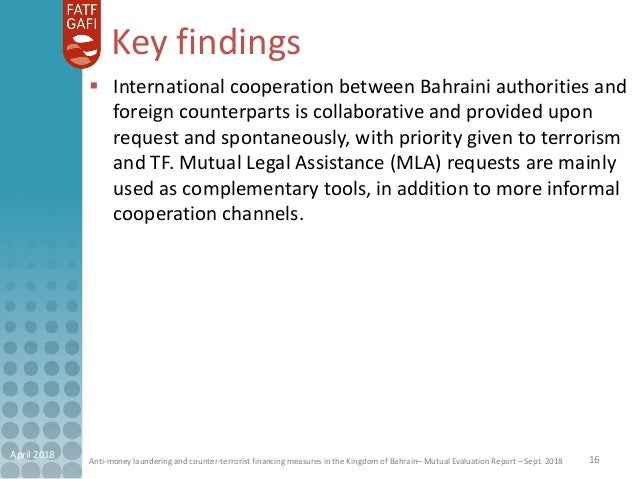

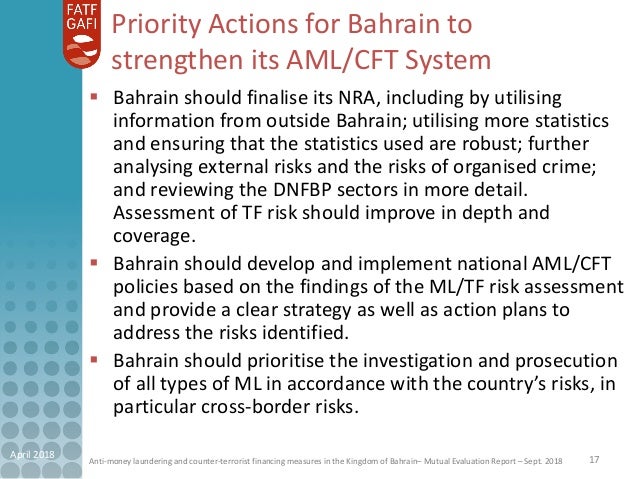

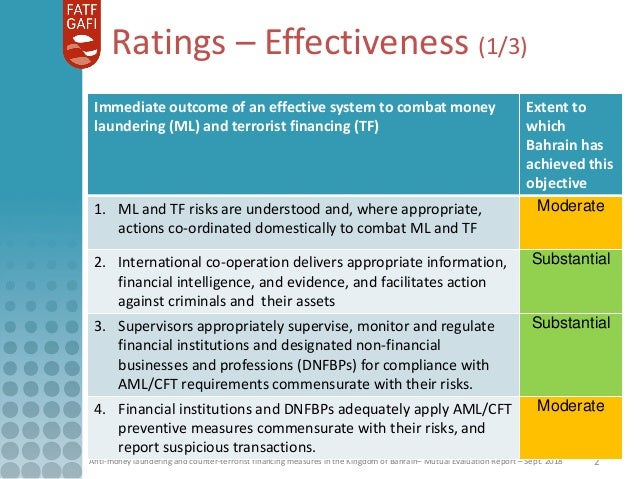

The Central Bank of Bahrain views the fight against money laundering AML and combating the financing of terrorism CFT as a key priority. Key Findings from the report are as follows. The Central Bank of Bahrain views the fight against money laundering AML and combating the financing of terrorism CFT as a key priority.

Central Bank of Bahrain requires its licensees to comply with all aspects of legislation related to Anti-Money Laundering and combating terrorist financing including Customer Due Diligence. 973 17111351 1711136017111338. Article 4 The Policy Committee for the Prevention and Prohibition of Money Laundering.

Bahrain Anti Money Laundering Law Amendment Approved Lexisnexis Middle East

Bahrain 5 Future Bank Officials Jailed For Money Laundering Bahrain Gulf News

Bahrain S Measures To Combat Money Laundering And Terrorist Financing

The Changing Dynamics Of Anti Money Laundering Combating Terrorism Financing In The Fintech Era Union Of Arab Banks

Anti Money Laundering Practices And Ethical Consumerism A Case Of A Bahraini Bank Business Management Book Chapter Igi Global

Interior Minister Hails Accreditation Of Bahrain S Follow Up Anti Money Laundering Report

Accreditation Of Bahrain S Follow Up Anti Money Laundering Report Hailed

Anti Money Laundering Department Achievement Infographics

Bahrain S Measures To Combat Money Laundering And Terrorist Financing

Http Www Alubafbank Com Media Document Due Dillegence Aml Questionnaire 15 08 25 Pdf

Http Www Ahlia Edu Bh Cms4 Wp Content Uploads 2018 05 Salek Pdf

New Measures For Anti Money Laundering Imposed On Law Firms In Bahrain Mena Chambers

Documents Financial Action Task Force Fatf

Bahrain S Measures To Combat Money Laundering And Terrorist Financing

The world of regulations can appear to be a bowl of alphabet soup at times. US money laundering regulations are not any exception. Now we have compiled an inventory of the top ten cash laundering acronyms and their definitions. TMP Danger is consulting agency focused on defending financial services by decreasing danger, fraud and losses. We've got large financial institution experience in operational and regulatory threat. Now we have a robust background in program administration, regulatory and operational threat as well as Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many opposed consequences to the organization due to the dangers it presents. It will increase the probability of major risks and the opportunity cost of the bank and finally causes the bank to face losses.

Comments

Post a Comment