Money Laundering Regulations 2017 Key Changes

The idea of cash laundering is very important to be understood for these working within the financial sector. It's a course of by which dirty money is converted into clean money. The sources of the cash in precise are prison and the cash is invested in a way that makes it appear to be clean money and conceal the identification of the felony part of the money earned.

While executing the monetary transactions and establishing relationship with the brand new clients or sustaining present prospects the duty of adopting satisfactory measures lie on each one who is a part of the group. The identification of such factor to start with is simple to take care of as an alternative realizing and encountering such situations in a while in the transaction stage. The central bank in any nation offers full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present enough security to the banks to discourage such conditions.

The 4MLD seeks to give effect to the international standards for combating money laundering and terrorist financing. Changing the approach to customer due diligence with restrictions to apply simplified due diligence and obligation to consider both customer and geographical risk factors in deciding whether simplified due diligence is appropriate.

Aml In Switzerland Reform Of Money Laundering Act Amla In 2021

Based approach the documentation and justification of a firms approach to combat money laundering has further increased in importance.

Money laundering regulations 2017 key changes. The UK Money Laundering Regulations 2017 Regulations 2017 which implement the EUs Fourth Money Laundering Directive 4MLD came into force on 26 June 2017 repealing the Money Laundering Regulations 2007 Regulations 2007. The Money Laundering Regulations 2017 contain a number of amendments to the existing Money Laundering Regulations including changes to scope due diligence and reliance on third parties beneficial ownership PEPs and changes to the supervision bodies and enforcement powers. Key differences between the draft and the final Money Laundering Regulations 2017 Regulation 19.

20072157 and the Transfer of Funds Information on the Payer Regulations 2007 SI. Regulated business must regularly review and update their policies and controls and maintain a written record of all changes to AML policies as a result and steps taken to communicate the changes to staff. Enforcing emphasis on record keeping practices.

The key changes. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. The requirements of 4MLD have been retained in the 2017 Money Laundering regulations with the updated regulatory amendments being added in accordance with 5MLD to form The Money Laundering and Terrorist Financing Amendment Regulations 2019.

Helping you navigate the changes A summary of MLR 2017 The MLR 2017 introduces a number of new and updated requirements on entities. Anti-money laundering AML and counter terrorist financing CTF regime is up to date and effective in seeking to tackle the risk of money laundering ML and terrorist financing TF. HM Treasury is holding two consultations as part of its twin-track approach to reviewing the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs.

Key changes and impact for Art Businesses By Yulia Tosheva on 20th July 2017 in Knowledge Summary. 20073298 with updated provisions that implement in part the Fourth Money Laundering Directive 2015849EU fourth money laundering directive of the European Parliament and of the Council of 20th May 2015 on the prevention of the. These Regulations replace the Money Laundering Regulations 2007 SI.

Regulations 2017 as amended The Amended Regulations Key Changes Document This guidance is intended to summarise the key changes in the new Anti-Money Laundering AML regulations the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 as amended for legal professionals that are in scope. These proposed regulations will supersede the current regulations 2007 and represent efforts to transpose the EUs Fourth Money Laundering Directive and the. The UK Money Laundering Regulations 2017 Regulations 2017 which implement the EUs Fourth Money Laundering Directive 4MLD came into force on 26 June 2017 repealing the Money Laundering Regulations 2007 Regulations 2007.

Key Issues from the Draft Money Laundering Regulations 2017 Following a series of consultation processes HM Treasury has published a draft of the Money Laundering Regulations 2017. Money laundering 2017 key changes. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities.

Review of the UKs anti-money laundering AML and counter-terrorist. Businesses regulated by MLR 2017 must assess the risk that they could be used for money laundering including terrorist financing. UK Money Laundering Regulations 2017.

Central to MLR 2017 is the increased emphasis on risk assessment and furtherance of the application of a risk - based approach. The Directive will come into force on 10 th January 2020 and contains enhancements to the existing provisions as mandated by the EUs 4 th Money Laundering Directive 4MLD which was implemented in the UK through the Money Laundering Regulations 2017. Amendments to the MLRs 2017 statutory instrument 2022.

The following areas summarise some of the key points of the regulation. One of the key differences is that those who the regulations apply to are obliged to adopt a more risk-based approach towards anti-money laundering particularly in how they conduct due diligence. However you should be aware that the presence of one or.

Pdf Compliance And Corporate Anti Money Laundering Regulation

Pdf Anti Money Laundering Regulations And Its Effectiveness

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

Finalization Of The 4th Anti Money Laundering Directive Bankinghub

Anti Money Laundering 2021 The Anti Money Laundering Act Of 2020 S Corporate Transparency Act Iclg

Https Www Europarl Europa Eu Regdata Etudes Idan 2021 659654 Ipol Ida 2021 659654 En Pdf

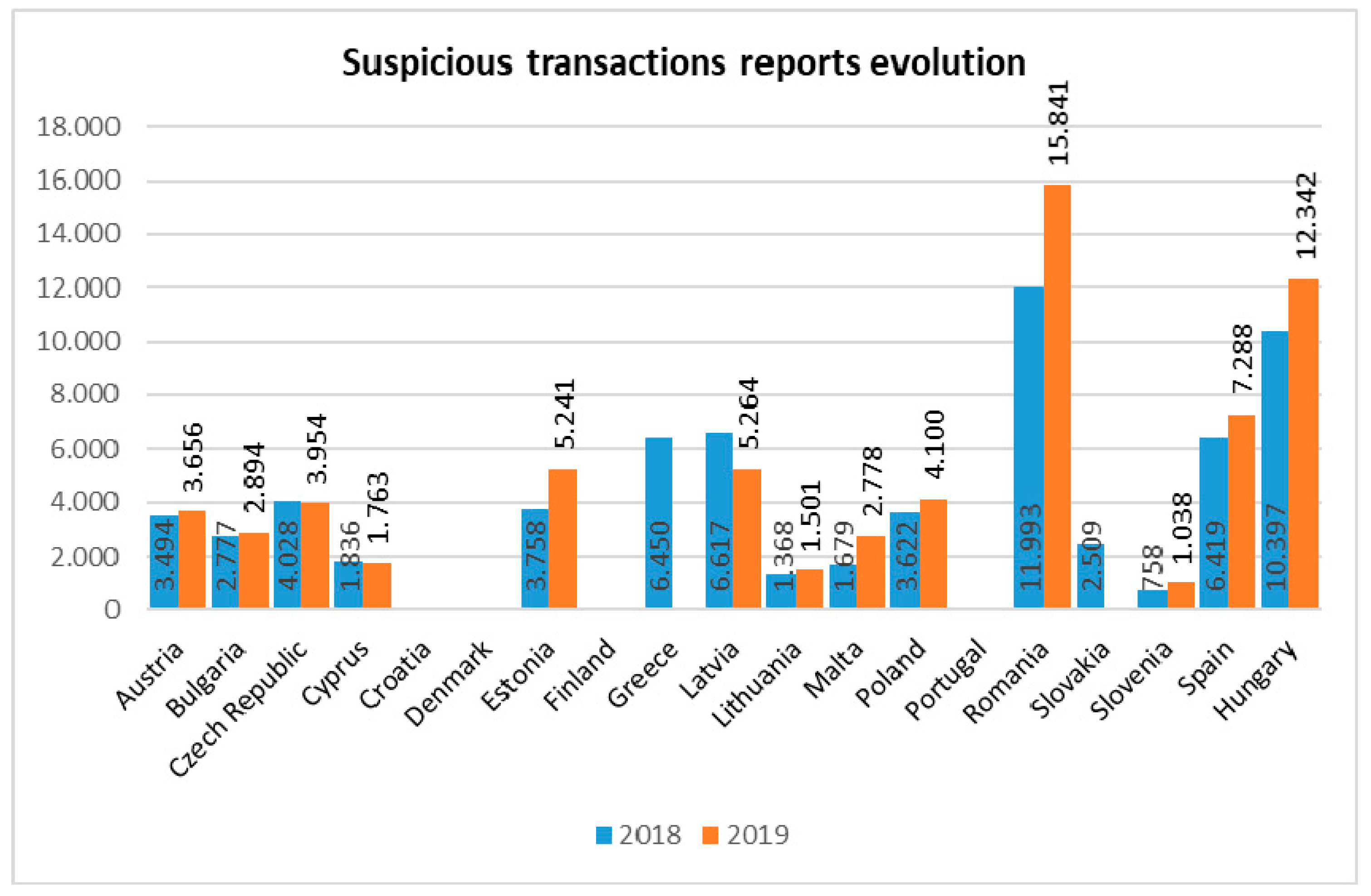

Risks Free Full Text Efficiency Of Money Laundering Countermeasures Case Studies From European Union Member States Html

Pdf Anti Money Laundering Regulation And The Art Market

The Money Laundering Regulations 2017 Are Now In Force Are You Compliant Deloitte Uk

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data

Risks Free Full Text Efficiency Of Money Laundering Countermeasures Case Studies From European Union Member States Html

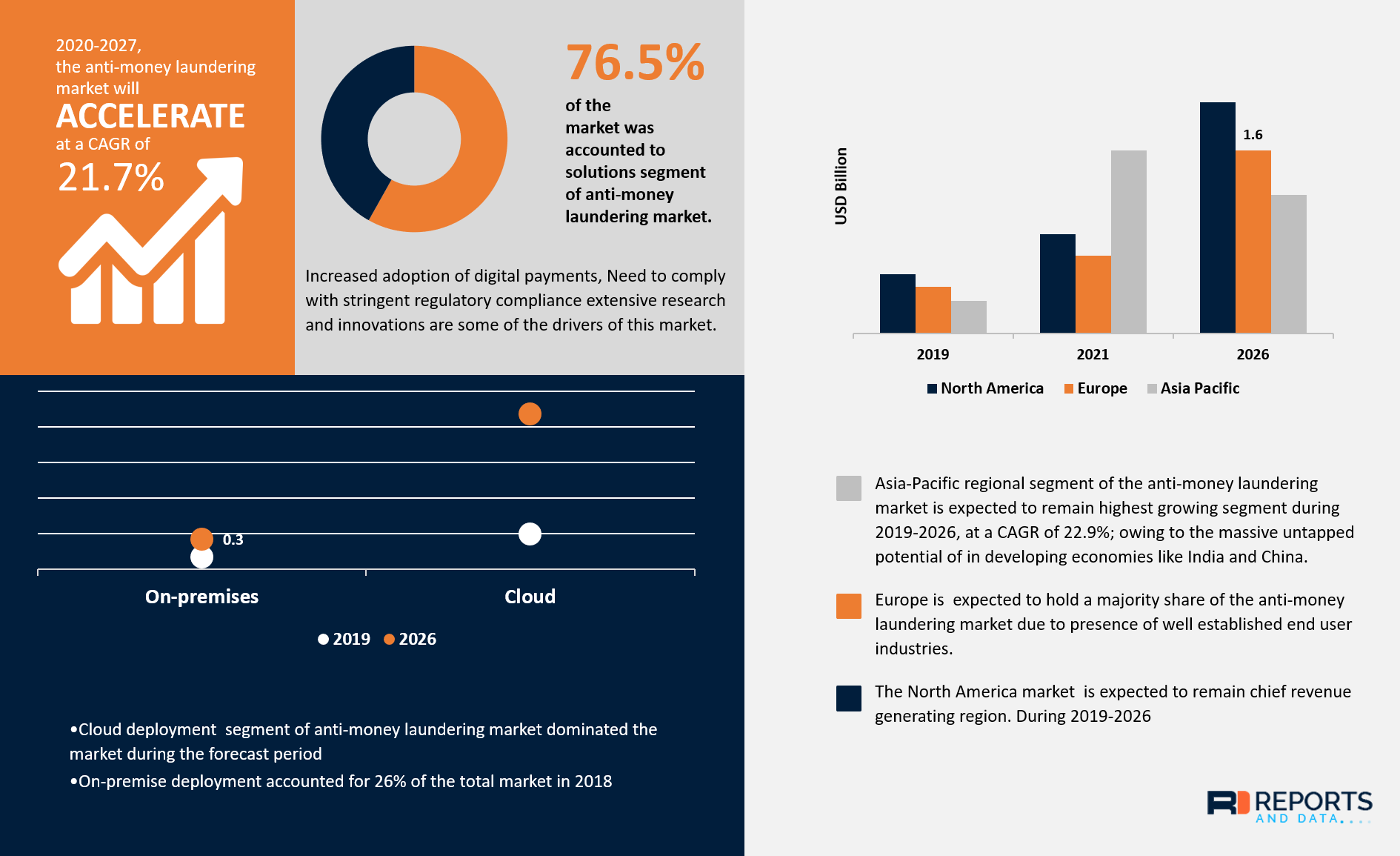

Anti Money Laundering Market Size Growth Global Report

Eu Policy On High Risk Third Countries European Commission

The world of regulations can appear to be a bowl of alphabet soup at occasions. US cash laundering regulations aren't any exception. We have now compiled a listing of the top ten money laundering acronyms and their definitions. TMP Threat is consulting firm targeted on protecting financial services by lowering risk, fraud and losses. We've got big financial institution experience in operational and regulatory danger. We have a robust background in program administration, regulatory and operational risk as well as Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many adverse consequences to the organization because of the risks it presents. It increases the likelihood of major risks and the chance cost of the financial institution and finally causes the bank to face losses.

Comments

Post a Comment